Master Credit Risk -

with Scalable AI

More Efficiency, Less Risk

KEBA Digital combines Artificial Intelligence and Predictive Analytics to proactively manage credit risk and enable real-time decision-making. By anticipating potential defaults before they occur, we help financial institutions safeguard portfolios and strengthen customer trust.

The Challenge:

Volatile Markets and Rising Credit Defaults

Banks and financial institutions face new challenges:

Increasing market volatility, geopolitical uncertainties, and shifting customer behavior are driving up credit default risks.

Traditional credit scoring models are reaching their limits – they are static, backward-looking, and too slow to respond to change.

Lack of transparency and manual assessments lead to delayed decisions and higher risk exposure.

The Solution:

AI-Driven Credit Risk Management

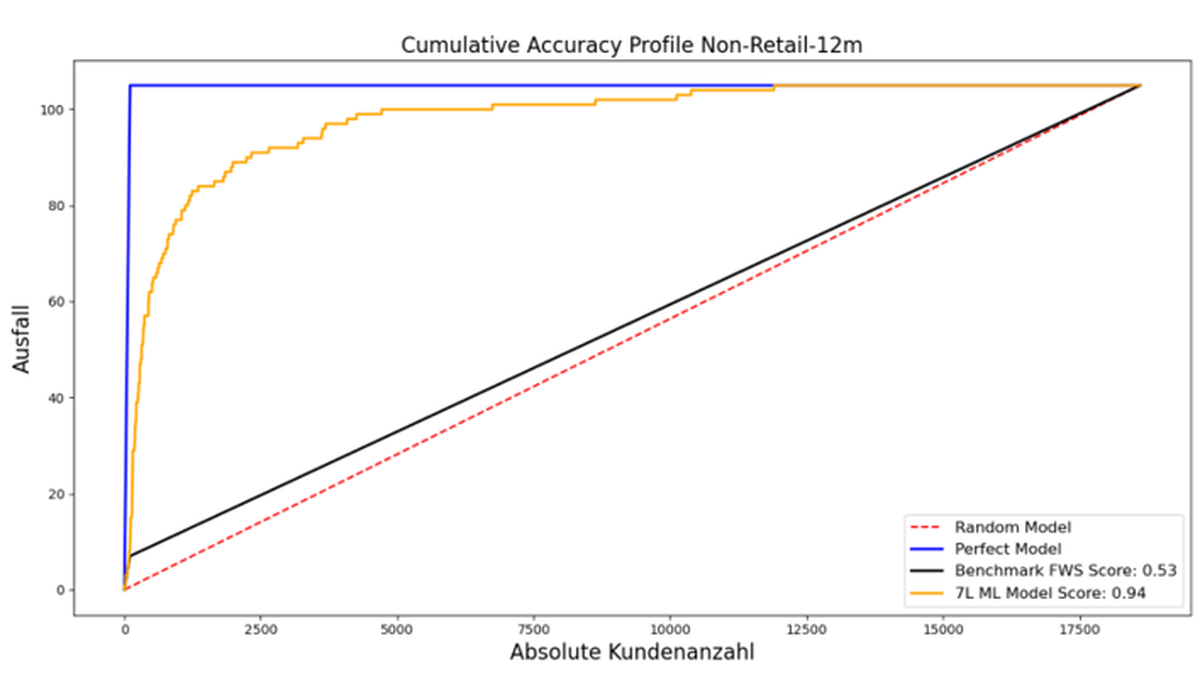

KEBA Digital delivers proactive and dynamic risk analysis powered by Machine Learning, real-time data, and automated decision models.

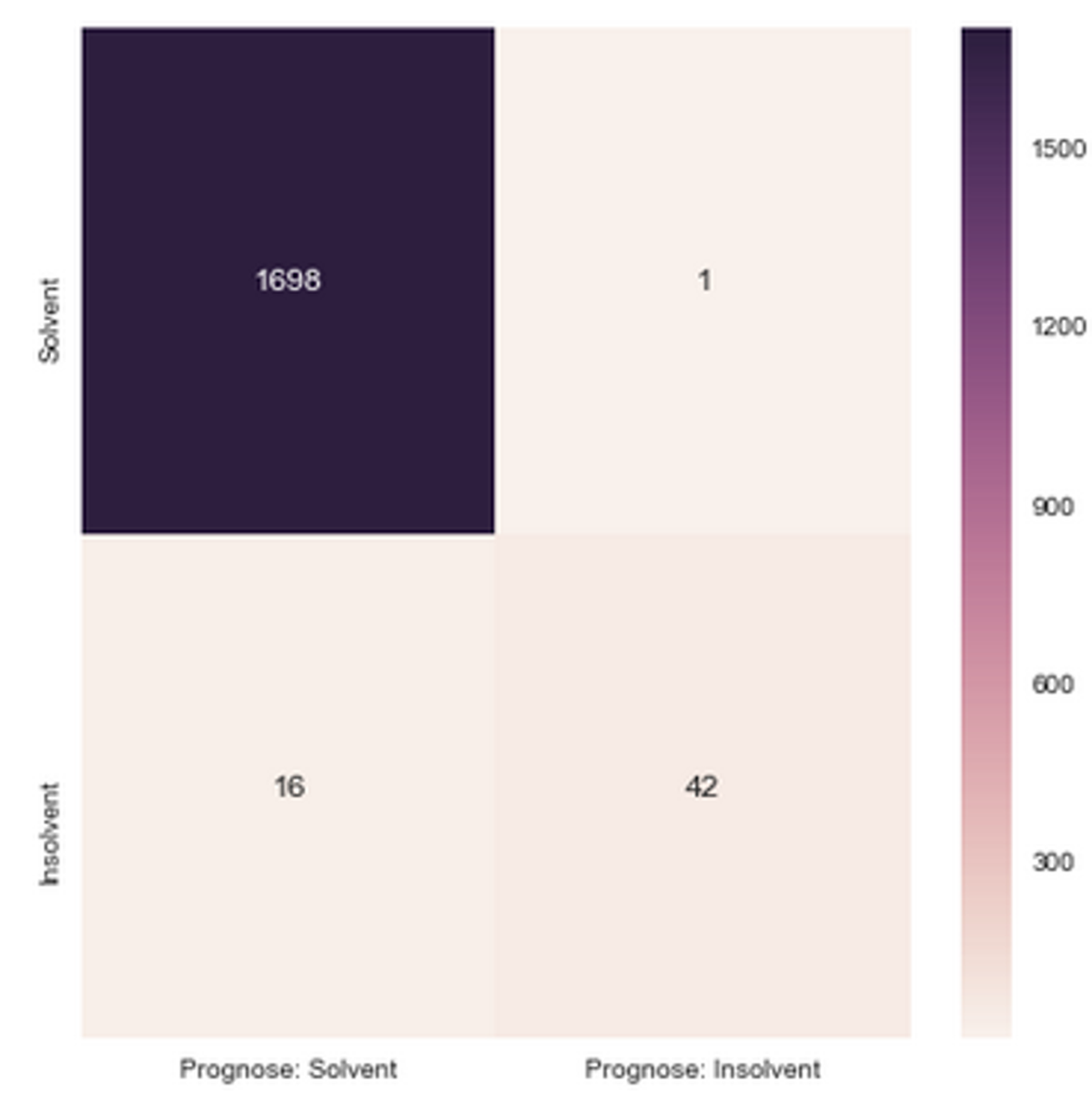

This enables financial institutions to detect credit risks early, continuously reassess them, and minimize defaults proactively.

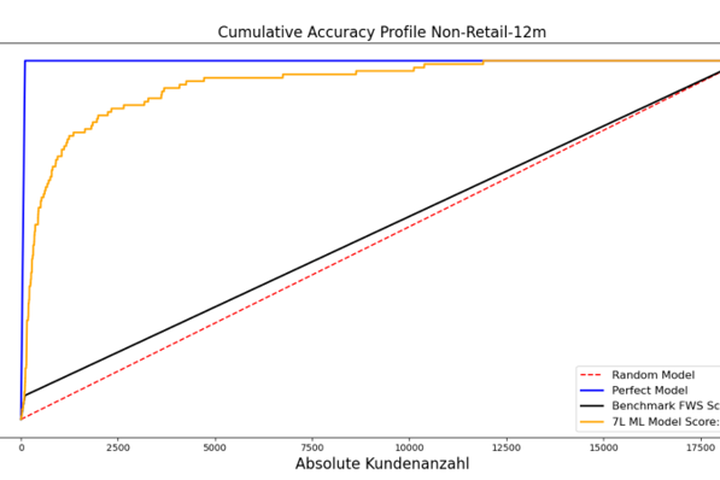

Preventive Risk Detection – Anticipate Credit Risks Before They Occur

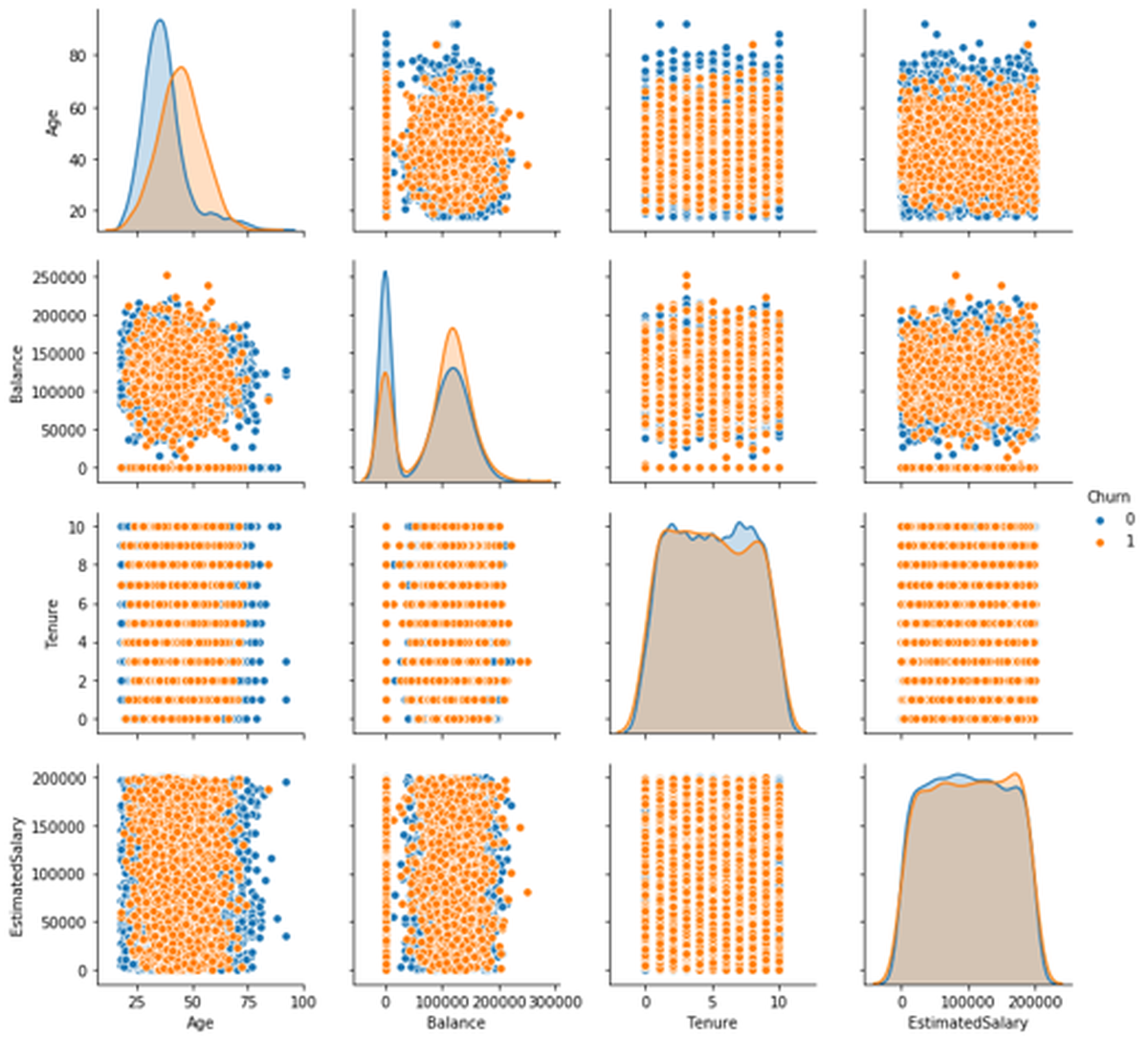

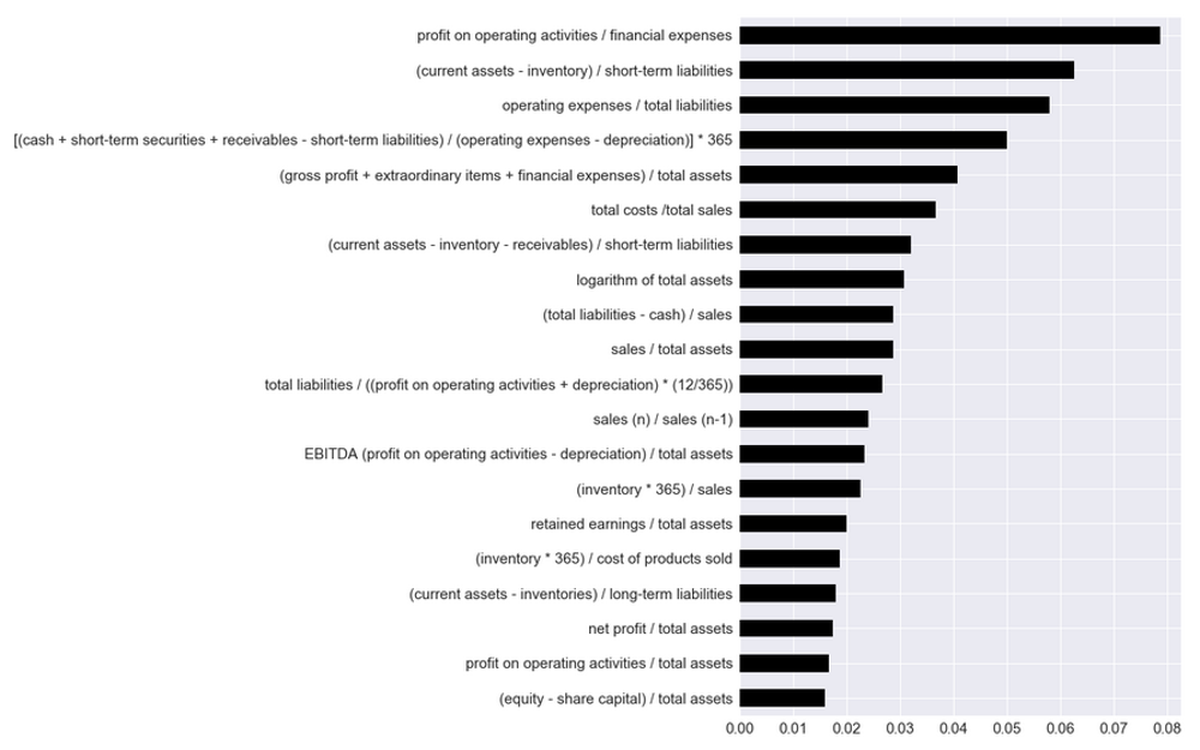

Our AI analyzes historical credit and transaction data, combined with current market information and external risk factors.

Through anomaly detection and predictive scoring, potential defaults are identified early – before they appear in traditional reporting.

Benefits:

- Early warning system for vulnerable loans

- Reduction of defaults and risk costs

- Improved portfolio quality through data-driven decisions

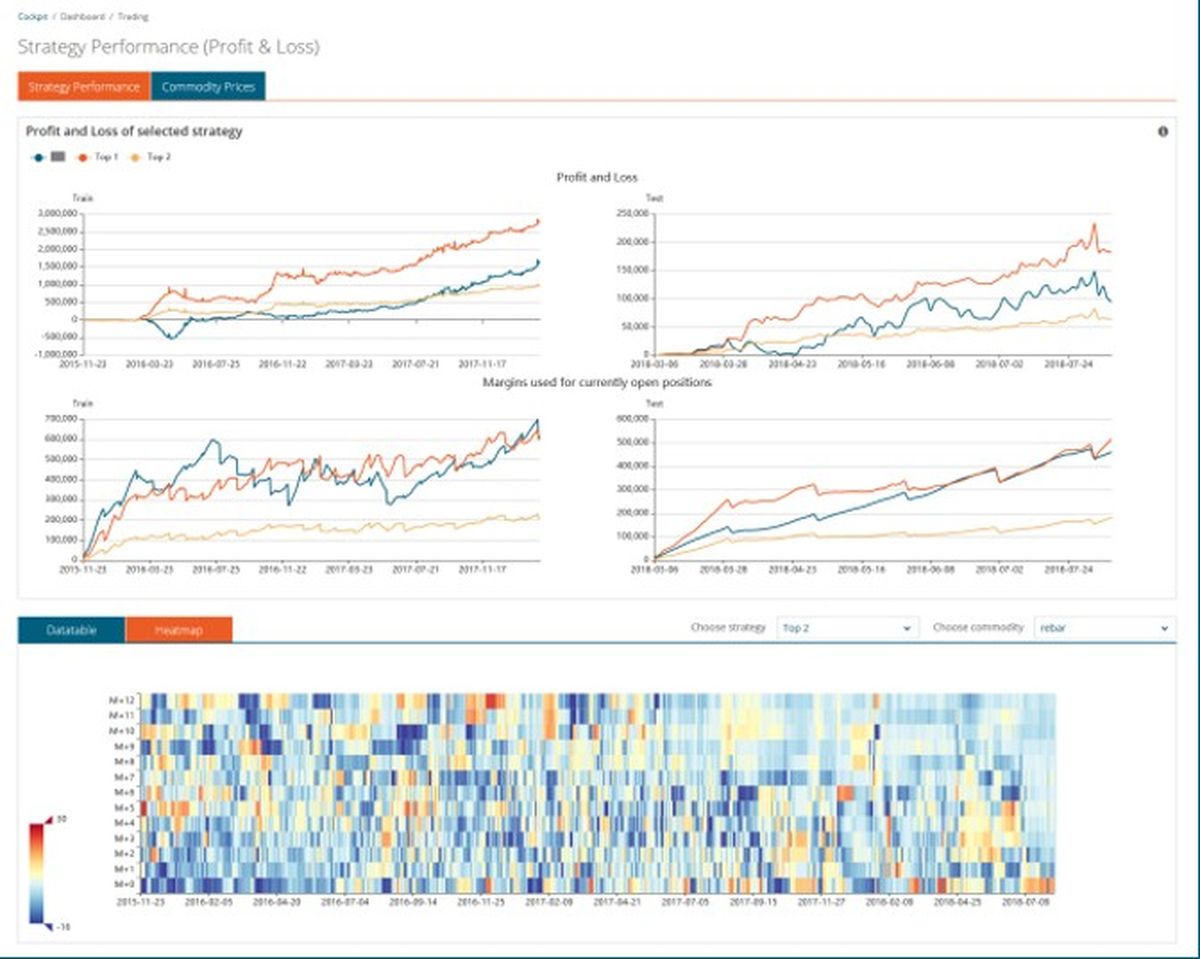

Dynamic Credit Rating – Real-Time Risk Assessment

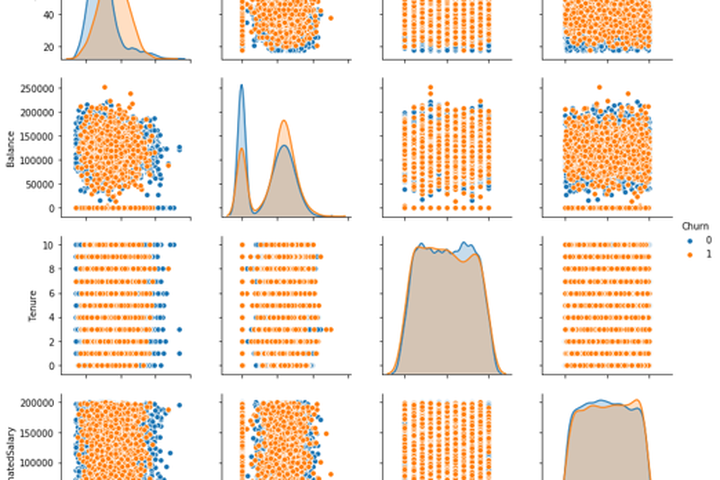

Instead of static ratings, KEBA Digital calculates credit risk dynamically and continuously. Behavioral and payment data feed into the risk model in real time. Score values automatically adjust to changes in payment behavior or market conditions.

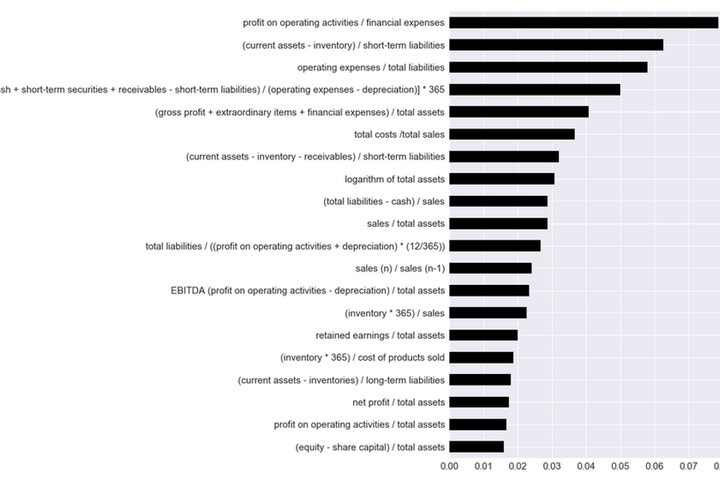

Used Technologies:

Gradient Boosting, Random Forests, Deep Neural Networks and Explainable AI (XAI) for transparent risk assessments.

Benefits:

- Automated real-time risk scoring

- High transparency through explainable AI

- Faster, more informed credit decisions

Fraud Detection & Anomaly Detection – Security Through AI

Beyond traditional credit risk, KEBA Digital uses AI-based models to detect fraudulent transactions and pattern deviations.

Our systems continuously learn and adapt to emerging fraud schemes.

Benefits:

- Real-time detection of complex fraud scenarios

- Protection against financial losses

- Automatic model updates through continuous learning

Technological Foundation

KEBA Digital leverages a modular AI architecture with scalable components.

Our systems are cloud- or on-premises-ready and integrate seamlessly into existing core banking, CRM, or risk management systems.

- Machine Learning (XGBoost, Random Forests)

- Deep Learning (from LSTM to KAN and NBEATS)

- Explainable AI (XAI)

- Anomaly Detection

- Realtime Data Integration

Your Benefits

with KEBA Digital

Risik Mitigation

Early detection of credit and default risks through predictive analytics

Transparency & Compliance

Traceable AI models thanks to Explainable AI

Efficiency Gains

Automatisierte Kreditentscheidungen in Echtzeit

Scalability

Applicable for banks, leasing companies & FinTechs

Thank you for your request. Our KEBA Customer Support will get in touch with you soon.

Locations

Newsroom

Edge

Chrome

Safari

Firefox