Fraud Detection

with AI

Detect Fraud Before It Happens

Our AI solutions identify suspicious transactions in real time, reduce losses, and enhance security – preventive, dynamic, and explainable. By continuously learning from evolving fraud patterns, we help financial institutions stay ahead of threats and protect customer trust.

The Challenge:

Complex Fraud Patterns and Growing Data Volumes

Digital business models, online payments, and automated processes create new risks:

Fraud patterns are becoming more complex, deception more subtle – while traditional rule-based systems react too slowly.

Manual checks are error-prone and costly, static systems generate too many false positives. Banks, insurers, and payment providers need preventive, adaptive systems that detect threats before they cause damage.

The Solution:

AI-Powered Fraud Detection

KEBA Digital combines machine learning, anomaly detection, and real-time data analytics to automatically identify fraud attempts. The AI learns from millions of transactions and detects even the smallest deviations from normal behavior – in milliseconds.

The result: a proactive security ecosystem that stops fraud before it impacts your business. Continuously evolving to counter new attack patterns, it ensures resilience, regulatory compliance, and customer trust – all at enterprise scale.

Preventive Detection Through Anomaly Analysis

Our AI models identify irregularities in transaction data, application flows, or user behavior that indicate potential fraud.

Historical patterns and current activities are continuously compared.

Technologies: Clustering, Random Forests, Autoencoders, Isolation Forest, Neural Networks.

Beneftis:

- Real-time detection of fraud scenarios

- Self-learning systems without rigid rules

- Minimization of false positives

Pattern Recognition Across Multi-Channel Data

Whether online banking, POS payments, or insurance applications – KEBA Digital’s AI analyzes data across all channels.

This enables detection of fraudulent activities spread across multiple systems or accounts.

Benefits:

- Holistic analysis across all data sources

- Identification of hidden fraud chains

- Early warning for suspicious networks

Explainable AI – Transparent Decisions

Trust is critical in financial services and insurance.

With Explainable AI (XAI), KEBA Digital makes AI decisions transparent and auditable.

Auditors and analysts can always see which factors influenced risk scoring.

Benefits:

- Explainable risk assessment for compliance and audits

- Transparency for customer interactions

- High regulatory security

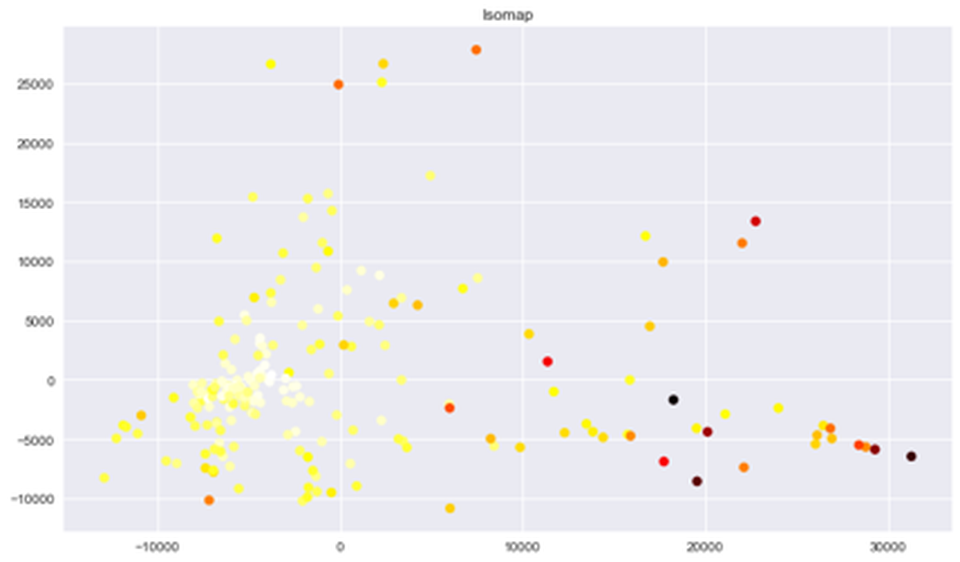

Visualization of Anomalies in Transaction Data

This visualization shows a projection of transaction data: dense clusters represent typical patterns, while isolated points indicate potentially unusual behavior – a key step in anomaly and fraud detection.

What becomes clear?

- Outliers and suspicious patterns are visible

- Potential risk cases can be identified

- Provides a foundation for advanced analysis and AI models

Technological Foundation

KEBA Digital’s fraud detection solution is modular, scalable, and designed for maximum response speed.

- Machine Learning (Random Forest, XGBoost)

- Deep Learning (Embeddings, Transformer Models)

- Graph-Based Network Analysis

- Explainable AI (XAI)

- Realtime Scoring Engine

Your Benefits

with KEBA Digital

Faster Detection

Real-time transaction scoring reduces response times

Lower Losses

Early identification prevents financial damage

High Accuracy

AI minimizes false positives and reduces analyst workload

Regulatory Security

Transparent, auditable decisions thanks to Explainable AI

Thank you for your request. Our KEBA Customer Support will get in touch with you soon.

Locations

Newsroom

Edge

Chrome

Safari

Firefox