Dynamic Insurance Premium Calculation -

Powered by AI

More Competitiveness, Less Risk

KEBA Digital is transforming the insurance industry with dynamic, AI-based pricing models – delivering risk-adjusted, personalized, and competitive tariffs. By leveraging real-time data and predictive analytics, we enable insurers to respond faster to market changes and customer needs.

The Challenge:

Rigid Tariffs and Limited Risk Insight

Traditional insurance models rely on static risk categories and historical averages.

This leads to unfair pricing, missed revenue opportunities, and a lack of flexibility.

Risk profiles are changing rapidly through real-time data – such as driving behavior, health metrics, IoT sensors, or market movements – far faster than conventional models can respond.

The Solution:

AI-Powered Dynamic Premium Calculation

KEBA Digital develops AI models that enable insurers to calculate premiums continuously and individually – based on behavior, usage, and risk in real time.

This makes pricing not only fairer but also more profitable and customer-centric.

Dynamic Pricing – Individual Premiums in Real Time

Our AI models automatically calculate premiums based on current data.

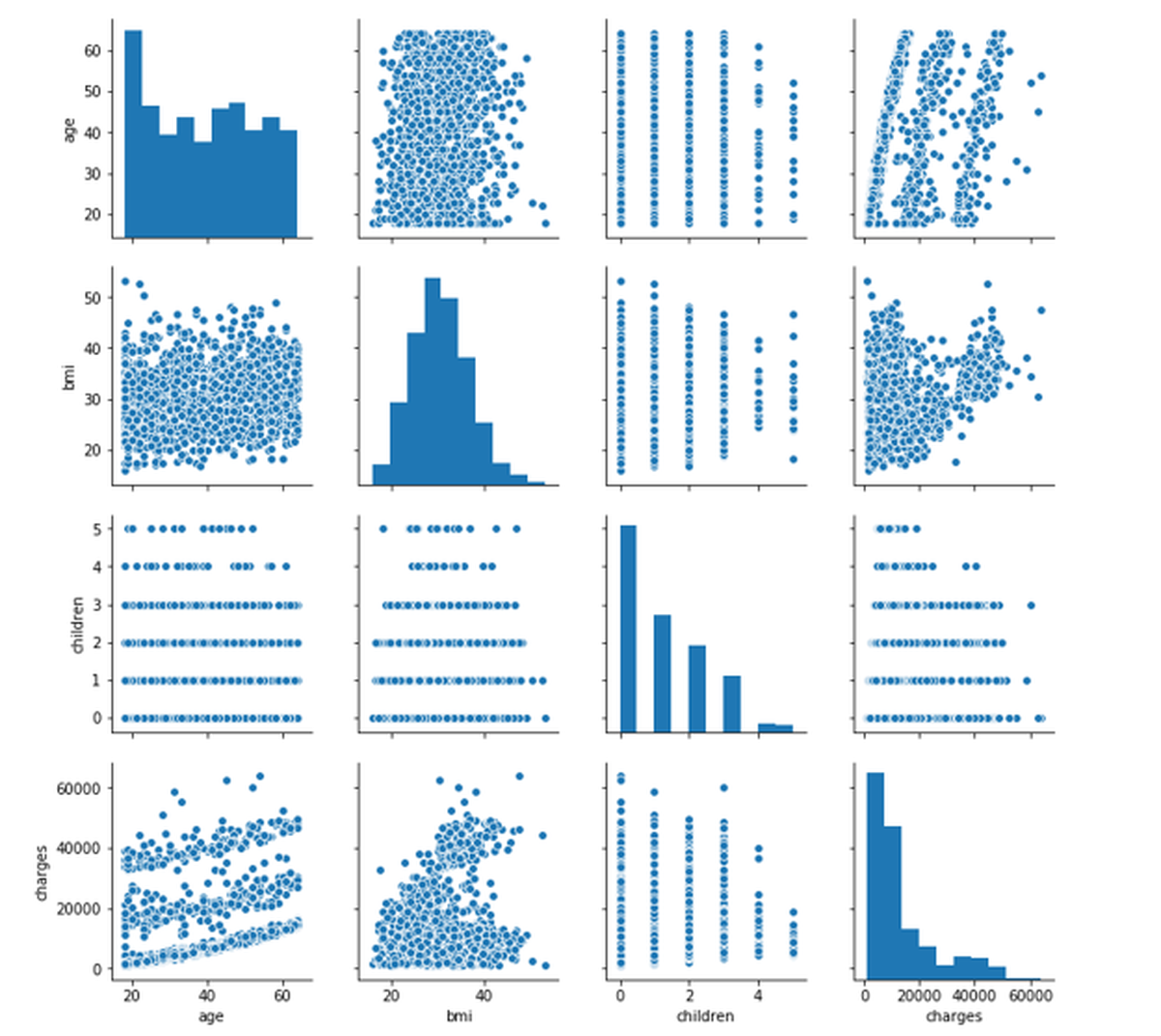

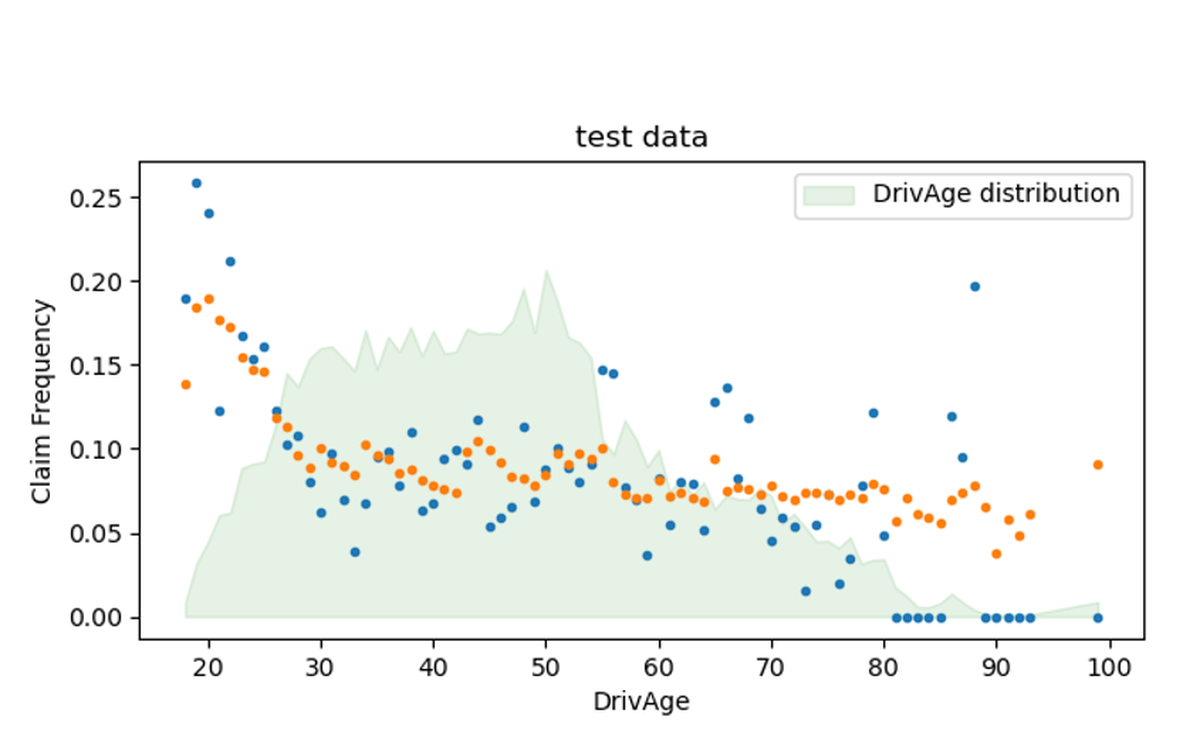

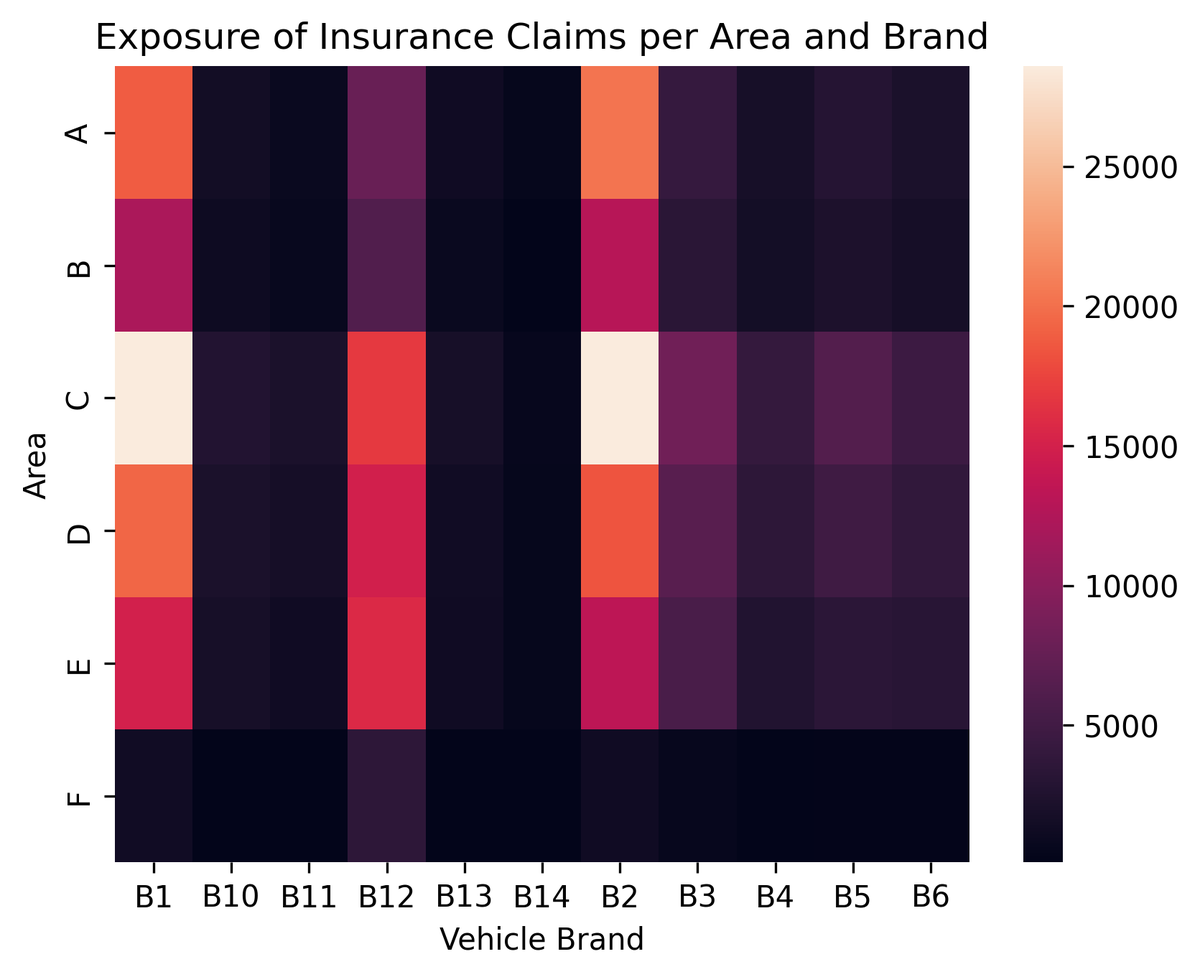

Tariffs adjust according to driving behavior, health status, usage patterns, or regional risk factors.

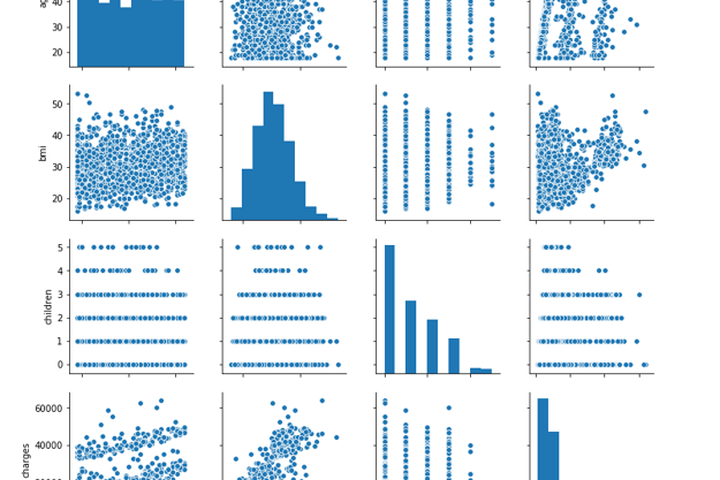

Technologies Used: Machine Learning, Time Series Analysis, Regression Models, and Clustering.

Benefits:

- Fair and risk-adjusted premiums

- Automatic adaptation to changing customer behavior

- Greater competitiveness through flexible pricing

Preventive Risk Analysis – Detect Risks Before They Occur

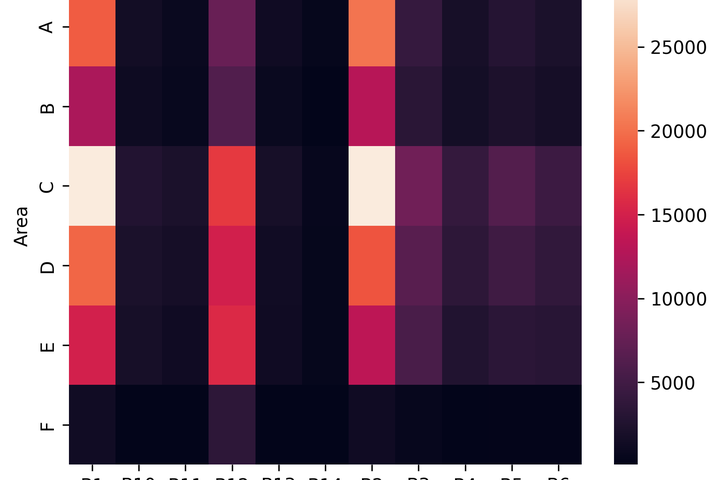

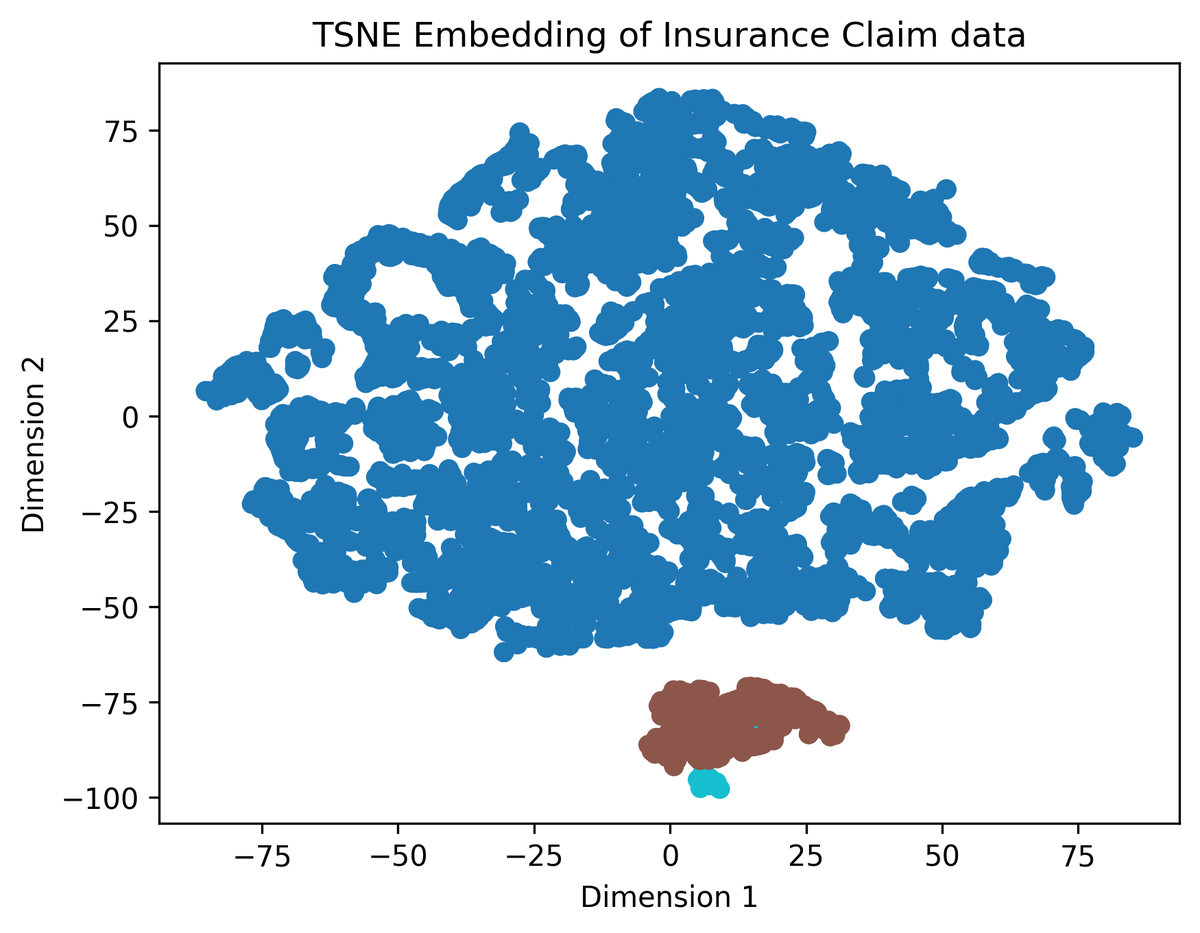

By combining historical claims data, IoT information, and external risk factors, AI identifies potential loss events early.

This enables preventive measures and reduces claim frequency.

Benefits:

- Early warning system for emerging risks

- Individualized risk assessment

- Lower claim frequency and improved risk calculation

Customer-Centric Pricing – Building Trust Through Transparency

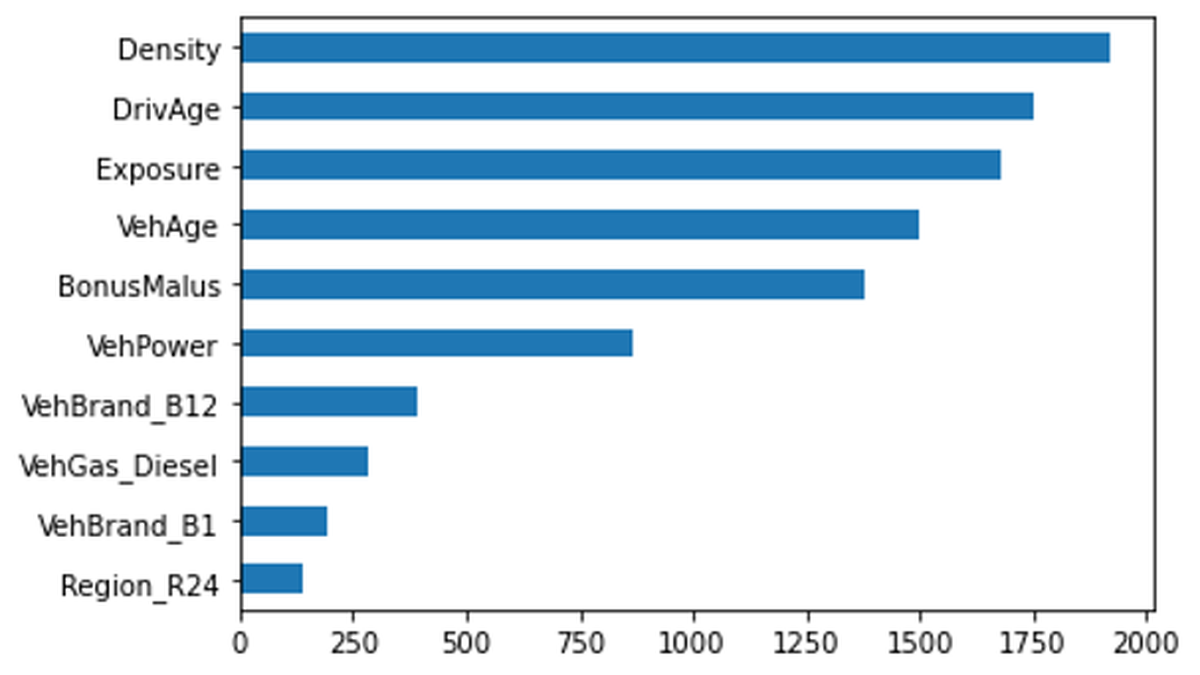

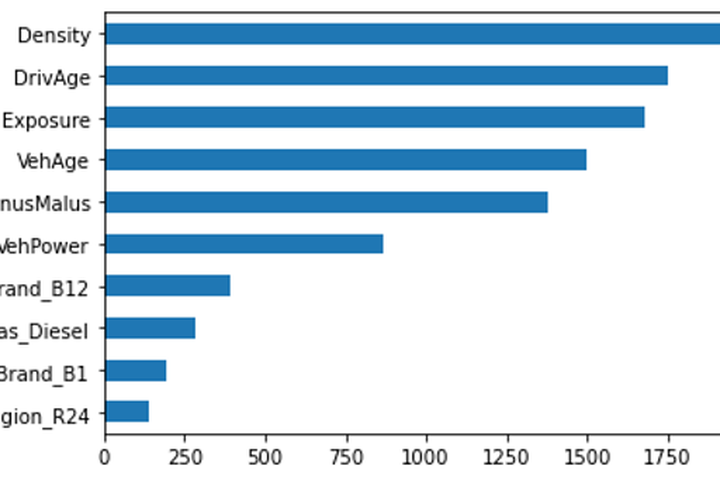

With explainable AI models (XAI), KEBA Digital creates transparency in pricing.

Customers and advisors can understand which factors influence premium levels – a key advantage for trust and acceptance.

Benefits:

- Increased customer satisfaction through transparent pricing

- Stronger loyalty through fairness and personalization

- Compliance-ready and auditable calculations

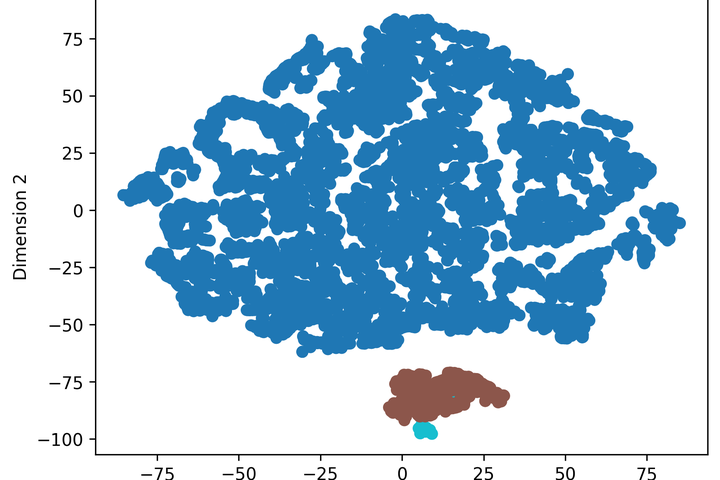

Visualizations of AI Use Cases for Insurance

Technological Foundation

KEBA Digital’s solution is built on a flexible AI framework that integrates data from diverse sources and processes it in real time.

The models are scalable and can be integrated into existing pricing systems, CRM platforms, or risk engines.

- Machine Learning & Regression

- Time Series Forecasting

- Clustering & Segmentation

- Explainable AI (XAI)

- Realtime Data Streaming

Your Benefits

with KEBA Digital

Competitive Advantage

Dynamic tariffs increase attractiveness and market share

Customer Satisfaction

Fair, transparent premiums build trust

Efficiency

Automated premium calculation reduces manual effort

Risik Management

Real-time data enables proactive risk control

Thank you for your request. Our KEBA Customer Support will get in touch with you soon.

Locations

Newsroom

Edge

Chrome

Safari

Firefox