Earn More with an E-Fleet on the Last Mile

- Knowledge

- Private

- Charging

- 7.7.2025

- Reading Time: {{readingTime}} min

Contents

Energy Consumption: The Major Advantage of Electric Vans and Electric Trucks

Despite typically having a higher base weight due to the battery, the energy consumption of electric vehicles is significantly lower compared to their combustion engine counterparts — by at least 50%, and often well over 60%, even when the conventional vehicle is equipped with a modern diesel engine. This translates into substantial savings in operating and per-kilometer costs.

The advantage becomes even more apparent on short distances and in urban traffic: stop-and-go driving increases consumption, as combustion engines often continue running while idling, tend to use inefficient gear ratios at low speeds, and cannot recover energy during braking. In contrast, an EV consumes the least energy at low speeds and uses virtually no energy when stationary. This can result in actual energy savings of more than 70% compared to diesel vehicles in city traffic.

Payload: A Design-Related Limitation

Due to the higher base weight caused by vehicle batteries, electric vans generally offer lower payload capacities within a given weight class compared to their combustion engine counterparts. To mitigate this disadvantage, regulations in Europe have allowed for an increase in the permissible total weight of electric commercial vehicles. For example, drivers with a standard license for vehicles up to 3.5 tons are permitted to operate electric delivery vans weighing up to 4.25 tons, and large trailers may operate at 42 tons instead of the usual 40 tons.

Nevertheless, a payload gap still exists in many cases between diesel and electric models currently on the market. Moreover, variants of the same EV model equipped with smaller batteries typically allow for a significantly higher payload than those with larger batteries offering extended range.

For this reason, it is particularly important to deploy vehicles in a logistics fleet according to specific operational needs. If cargo weight is of minor importance but volume matters — such as in parcel delivery — large electric vehicles with bigger batteries (if the route length demands it) may be well-suited. For heavier transport loads exceeding one ton — such as palletized goods or bulky items requiring two-person handling — efficient route planning becomes essential. This includes keeping distances short (allowing for smaller batteries) or scheduling quick charging stops at DC chargers during the day.

Acquisition Costs: Significantly Lower for Short and Medium Distances

Currently, electric vehicles still tend to be more expensive to purchase than comparable combustion engine models. While price parity has already been reached or is within sight for some passenger cars, the gap remains significantly wider for larger commercial vehicles. This is primarily due to the most costly components of a battery-electric vehicle (BEV): the battery itself and the associated electronic systems for charging and battery management.

As a general rule: the larger the vehicle class, the higher the acquisition costs — both in absolute and relative terms. For example, a long-haul electric truck can cost two to three times as much as a comparable diesel truck (+100% to +200%). If a diesel truck costs €100,000, the electric version may range between €200,000 and €300,000. These significantly higher upfront costs can deter companies — although, with proper usage, lower per-kilometer operating costs can quickly offset this initial disadvantage.

However, the picture is much more favorable when it comes to smaller delivery vehicles. A panel van of size L3H2 (medium length, high roof) from a major electric vehicle manufacturer costs around €40,000 net as a diesel version in Germany. The same model in its electric version is priced at approximately €51,500 net (both list prices as of July 2025). This equates to a roughly 29% higher initial investment for logistics companies. Compared to the higher percentages in larger vehicles, this disadvantage is relatively moderate and can be quickly compensated by significantly lower per-kilometer costs (variable cost per mile, consisting of energy and maintenance expenses).

To shorten the payback period, the most important lever to control operating costs must be optimized — and that is charging costs.

Charging Costs: Minimization Through the Right Charging Infrastructure

The advantage of electric last-mile delivery vehicles — ranging from delivery vans to small trucks with battery capacities between 50 kWh and 100 kWh (offering real-world ranges of 150 km to 300 km) — lies not only in their relatively low purchase price. Their manageable battery size also allows for practical charging times without requiring fast chargers (DC). Most of these vehicles are parked overnight and can be slowly charged with alternating current (AC) on company premises. This AC charging offers two key cost advantages:

1. There is no need for a more capital-intensive fast-charging (DC) infrastructure.

2. Low-cost night-time electricity can be utilized.

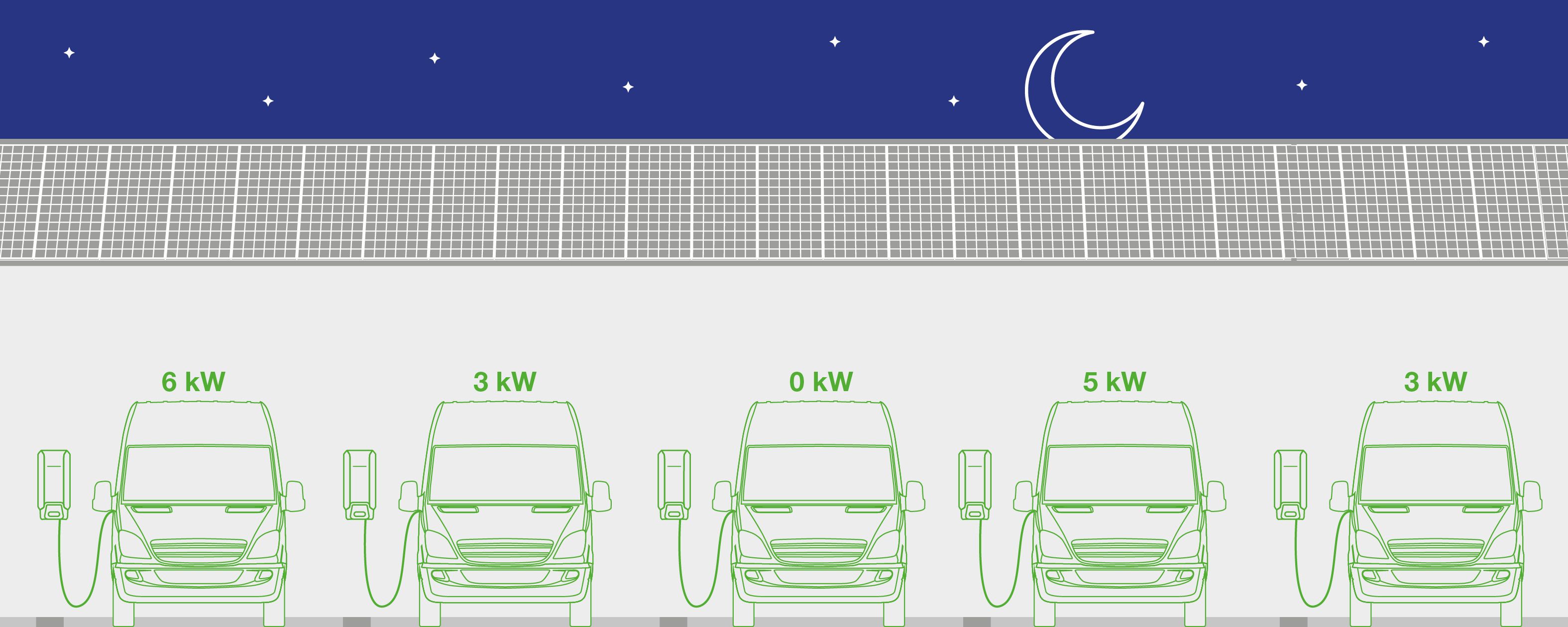

With intelligent charging management, monthly grid fees can be significantly reduced — even for large fleets — because these fees are based on the maximum power drawn at a site, even if that peak occurred only once. For example, vehicles with relatively empty batteries will initially charge at higher power, while those with a higher state of charge will be throttled. The key is to ensure that all vehicles are ready for use in the morning while avoiding load peaks during the charging process.

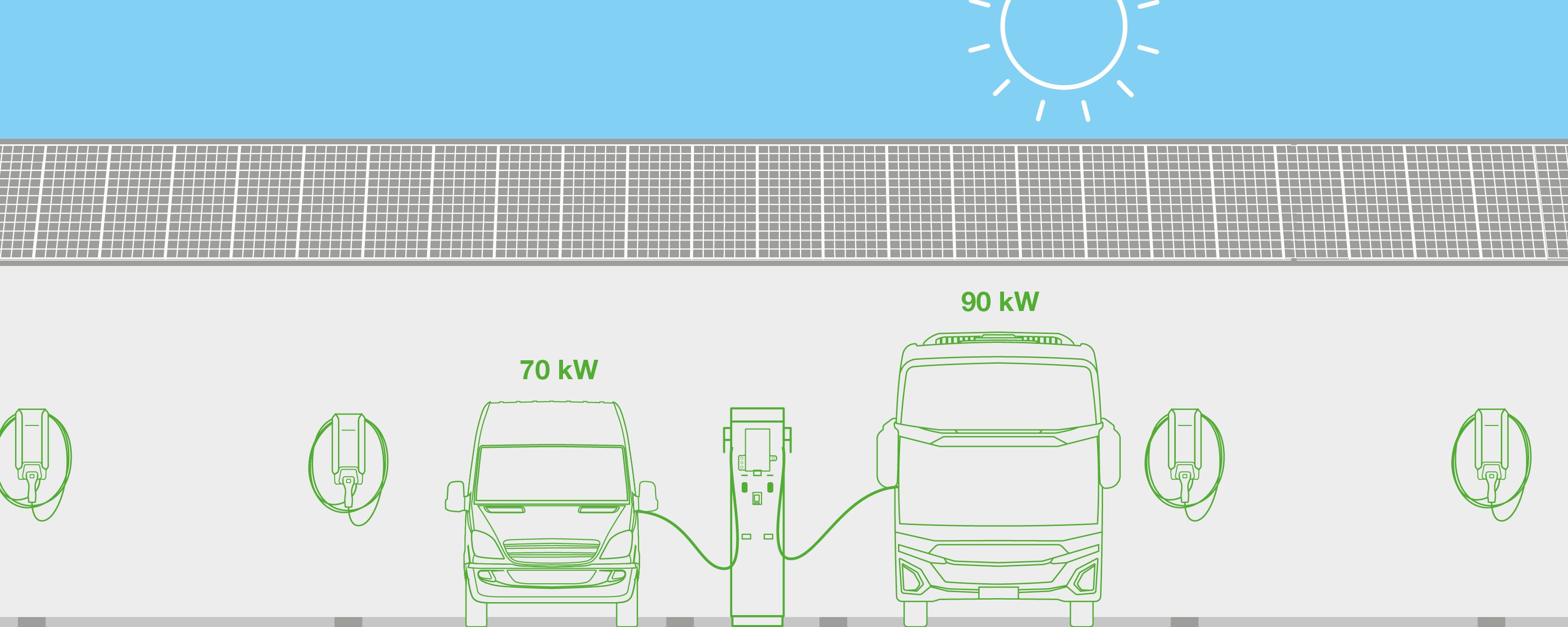

If business operations include shuttle routes between delivery destinations and the company site, short daytime charging stops can also be used to top up vehicle batteries. In such cases, a DC charging infrastructure is advisable, as it not only enables fast charging but also supports the use of self-generated solar power. This further reduces long-term operating costs.

In summary, electric commercial vehicles clearly outperform in terms of cost when used for short and medium distances. With only slightly higher acquisition costs compared to combustion engine models and significantly lower per-kilometer operating costs, total cost of ownership (TCO) is on average 25% lower — and can be even greater depending on the route profile.